| Key trends driving growth of transparent barrier films and barrier foil packaging | |

| Release time:2017/5/1 | |

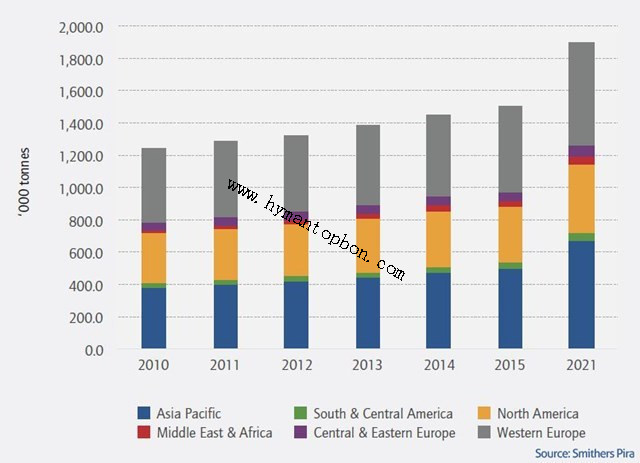

Growing consumer focus on convenience and sustainable lifestyles has made flexible packaging one of the fastest growing packaging areas over the past 10 years. The future impact of this trend on the two main competing barrier technologies used in this segment is analysed in depth in the new Smithers Pira report – The Future of Transparent Barrier Films versus Barrier Foil to 2021. Smithers Pira predicts global demand for transparent barrier films reached 1.5 million tonnes for 2015, and is forecast to grow at an annual average rate of 3.9% over the five-year study period, reaching 1.9 million tonnes in 2021. Consumption of the alternative barrier solution – flexible aluminum foil packaging – is projected to have reached 2.5 million tonnes in 2015. This will increase at an average annual rate of 2.5% per year, reaching almost 3 million tonnes by 2021. Continued rapid growth is predicted in emerging markets with improving living standards and increasing consumption of packaged products driving demand. Transparent barrier films are replacing traditional materials, such as flexible foil, for various applications due to consumer demand for packaging transparency, feasibility, and the use of metal detectors and microwave ovens.

Total demand for transparent barrier films is forecast to approach 1.9 million tonnes in 2021. Key markets The US is the largest material market for transparent barrier films, followed by Japan with respective volume shares of 21% and 17% in 2014. Western Europe is the largest regional market with 35% of global market volume, followed by Asia Pacific and North America. From 2010 to 2014, Asia Pacific was the fastest-growing region with China and India driving expansion. For the forecast period 2015–2021, Smithers predicts the Middle East and Africa will record faster-than-average annual growth rates of 6.7% in transparent barrier films. North America, Western Europe and Japan are relatively mature markets and are forecast to show below-average growth for transparent barrier film during the forecast period. In terms of packaging incorporating flexible foil, Western Europe is also the largest regional market for flexible aluminium foil packaging film, followed by Asia Pacific and North America. The Middle East and Africa, and South and Central America will lead growth in aluminium foil packaging film sales during the forecast period 2015–2021. Despite Asia Pacific being the largest overall market for packaging, foil is not the favourite packaging option for brand owners in China and India. The high barrier demands are mainly serviced by metallised polyethylene terephthalate (PET) and cast polypropylene (CPP). Food, convenience and pharmaceutical packagingOver the past two decades, there has been continual development of monolayer and multi-layer flexible packaging products. Progress has moved from simple monolayer bags and wraps to coextruded or laminated engineered multi-layer and coated constructions comprising plastics, paper and metal foils, coatings and other additives. These flexible packages provide a high barrier to gas and vapour, extended shelf-life and convenience, which are increasingly demanded in food, consumables and pharmaceutical packaging. Food packaging continues to be the largest end-use segment for transparent barrier films and foil flexible packaging. The fastest growing applications for pouch packaging include snack foods, beverages, meat, produce, pet food, pet supplies, pharmaceuticals and medical devices. The growth in food packaging uses is being driven by the growth of single-person and empty-nest households, families with all working adults, and the resulting consumer demand for convenience, shorter preparation times and smaller package sizes. The consumer move to on-the-go and healthy eating is also pushing single-serve packaging for snacks and beverages. While single-serve packages usually employ more packaging material per unit weight of packaged product than conventional larger packages, they also provide advantages in decreasing waste of food and other perishable contents. Growth of foil flexible packaging is partially due to the growing demand for convenience foods and pharmaceutical packaging, but the majority of foil packaging’s growth is due to the expansion of the market in emerging economies -- not due to growth within the foil market itself. Price instability has also had an effect; aluminum foil is used for a wide range of packaging products, such as foil laminates, foil lidding, blister packaging and foil bags, sachets and pouches. Replacement of rigid packagingBoth barrier foil and transparent barrier films offer advantages over rigid packaging. Flexible packaging uses fewer resources and energy than other forms of packaging. It provides significant reductions in packaging costs, materials use and transport costs as well as certain performance advantages over rigid packaging. Use of flexible packaging can minimise package transport costs between the converter, packer/filler, retailer and end user. It not only takes up less space when empty than rigid packaging, but can also be constructed on the spot from roll materials at the filling location, thereby minimising transportation of ready-formed, but empty, packaging. Rigid packaging, such as metal cans or barrier plastic containers, has nearly reached its light-weighting limit. The next step is to replace rigid packaging with even lighter-weight flexible pouches. This has started to occur but is not yet widespread due to current low speed on filling lines for pouches opposed to bottles. Increased use of bio-based materialsA number of new barrier packaging materials will become commercialised over the forecast period. The intensive development of bio-based and biodegradable polymers is forecast to start as soon as materials from cheaper agricultural wastes and by-products become price-competitive with the current fossil-based materials. The use of bio-materials will also help promote the green credentials of packaging suppliers, converters and brand owners. The development of new barrier materials such as polyglycolic acid and nanocomposites will provide expanded opportunities for providing all-plastic high-barrier barrier films. Incorporation of high-barrier structures and intelligent and active packaging technologies will also provide opportunities for the manufacture of advanced packaging designs. From Smithers Pira |

|

| Print this page || Closed the window |